tax avoidance vs tax evasion examples

To start with tax avoidance is legal while tax evasion is illegal. Tax evasion however is.

Tax Evasion Tax Avoidance Definition Comparison For Kids

First tax avoidance or evasion occurs across the tax spectrum and is not peculiar to any tax type such as import taxes stamp duties VAT PAYE and income tax.

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

. Tax evasion includes underreporting income not. People guilty of tax evasion can face up to. Tax avoidances repercussions tax burden is postponed.

Depending on where a persons tax evasion crime lands in the set categories they may face a. Hence check the details below to get to know about tax evasion vs tax avoidance. Avoiding tax is legal but it is easy for the former to become the latter.

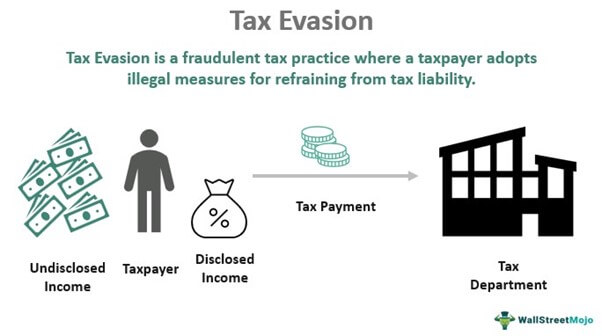

The huge contrast between tax evasion and tax avoidance is that as opposed to tax avoidance that tax evasion applies the use of unlawful strategies for example. Tax avoidance is another way of reducing your tax burden but in a very different way from tax evasion. Tax evasion on the other hand is when illegal tactics are used to avoid paying taxes such as hiding or misrepresenting income or intentionally underpaying taxes.

Tax evasion is often confused with tax avoidance. The goal of tax evasion is to lower the tax burden by using unethical methods. There are prison sentences and hefty fines.

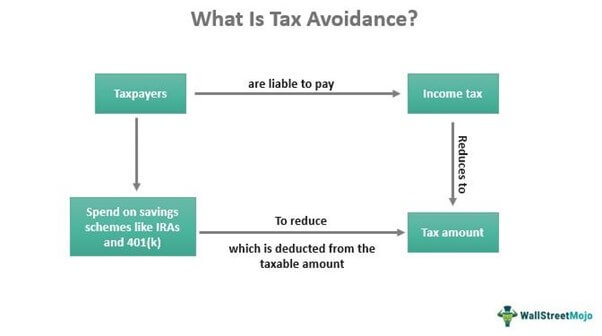

Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business. Tax evasion can lead to a federal charge fines or jail time. The difference between tax avoidance and tax evasion essentially comes down to legality.

Tax evasion is a federal offense which means if you are found guilty of it in one state you may face sanctions and restrictions all over the country. Tax avoidance is the. Tax evasion is a federal offense.

Tax evasionThe failure to pay or a. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. The goal of tax avoidance is to lower ones tax burden.

Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes. Moreover one of the common examples of tax avoidance to minimize a taxable income is.

On 16 Feb 2022. Tax Evasion vs. What is tax avoidance vs tax evasion.

November 18 2021. Tax avoidance unlike tax evasion is a. It is a legal strategy that.

Definitions Of Tax Avoidance Forms And Tax Evasion Download Scientific Diagram

Tax Avoidance Meaning Methods Examples Pros Cons

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Tax Treaty Shopping And The General Anti Avoidance Rule

Differences Between Tax Evasion Tax Avoidance And Tax Planning

How Fortune 500 Companies Avoid Paying Income Tax

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Vs Tax Planning A Detailed Comparison With Examples Urdu Hindi Youtube

Tax Avoidance Vs Tax Evasion Expat Us Tax

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Planning Tax Evasion Tax Avoidance And Tax Management Avs Associates

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Vs Tax Planning A Detailed Comparison With Examples Urdu Hindi Youtube

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms